Our free courses

See our Top 3 solutions to your trading problems!

Free

- The secret indicator that tells you exactly when to get in and out of the market.

Free

- One of my favorite trade strategies, complete with all the rules for entries and exits.

Free

- To Increase Consistent/Favorable Entries Aligned With The Market's Direction.

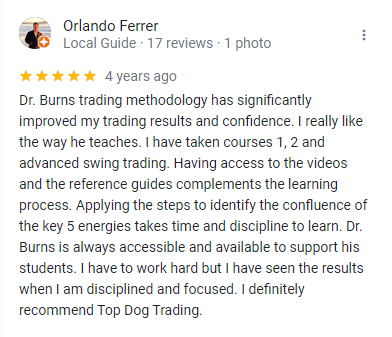

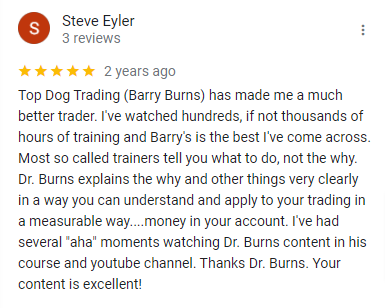

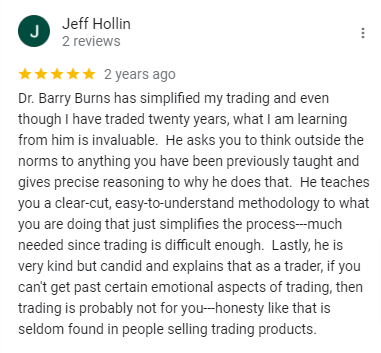

See what they’re saying

Our happy customers have a lot to say about our products and services!

“I just went to a trading weekend seminar and told every person I met about your fantastic training packages and the how it must be the best value training I have every paid my hard earned dollars for … I just wish someone had told me about Top Dog Trading years ago! Keep up the great work and thank you for helping me meet my trading and financial goals.”

Duane C

“I’ve been trying and trying and trying since ’96 and now, (when the wheels are coming off, it seems) I feel like the lone ranger being super confident of the future–really seems to me God has had a hand in it … All the best to your health and successful family!!”

Tom H

“Had learned some very bad trading practices and consequently lost a lot of money. I knew things had to change, I had heard of Barry through a friend and decided that I had nothing to lose by trying the courses. I have studied Foundation courses 1 & 2, along with a few other courses. I have all the courses and I am working my way through them.”

Susi Dee

“Dr. Barry Burns created a brilliant methodology along with everything else that is essential in trading. I went through the first two classes and I’m very happy with how it is changing a lot of things about my trading approach. Barry is also an incredible instructor that illustrates the key points over and over which is great. He has an amazing ability to really teach you what’s important through his many examples.”

Bryan

"I just wanted to thank you Barry for a first rate trading course. The content is fantastic and so concise, making it a real joy to learn. I look forward to moving onto Foundations Course 2 and more!"

James Stapleton

“I am into week 3 of reviewing the Foundation Courses. I find your courses and your delivery beyond excellent. They are so clear and well-laid out with numerous related techniques which scaffold each other. You don’t seem to be holding anything back; nothing leaves me guessing.”

Sue Miller

“It took me 2-3 yrs of reading and searching, only to come across your stuff by chance. By then, I had made enough mistakes, burned through my accounts an embarrassing number of times, but had finally discovered what questions were the right ones to be asking. It’s such a trial and error process. Wish I met you 18 months ago!”

Eric K

UX Designer

Dr. Barry Burns

As a husband and father supporting 6 people, I have to focus my trading on the bottom line: making money! We’ll cut through all the fluff and theory so you learn what’s practical in trading.

Spoiler alert: what’s taught in the traditional trading books no longer works in today’s markets dominated by Algos and HFTs. Join with me and learn what works now!